Energy Shifts again while Rapeseed dominates EU imports

The potential unwinding of the Ukraine conflict and possible lifting of Russian sanctions has sent shockwaves through energy markets today, with ICE gasoil showing early weakness. This bearish energy sentiment could test support levels, potentially pushing gasoil toward $600/mt this spring barring new geopolitical tensions. This energy backdrop is crucial for understanding the current dynamics in the European rapeseed market, where crushing margins are increasingly influenced by biofuel demand.

The seasonal patterns in European biofuel markets tell an interesting story. RME (Rapeseed Methyl Ester) premiums over ICE gasoil have flattened between Q1 and Q2 in the FOB ARA market, signaling the end of winter seasonal demand. Meanwhile, FAME 0 premiums are showing a Q1 to Q2 backwardation of +13, reflecting emerging spring demand in the ARA region. UCOME premiums maintain their contango at -28 from Q1 to Q2, adding another layer to this complex pricing picture.

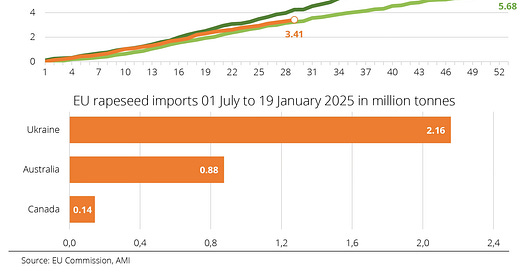

Against this backdrop, European rapeseed supplies remain abundant despite lower domestic production of 17.2 million tonnes. Strong import flows from Ukraine (2.2 million tonnes) continue to lead the way, while Australian shipments are estimated to exceed 1 million tonnes by the end of January, having already reached 875,000 tonnes by mid-January. This robust import program has kept German crushers, with their 10 million tonne annual capacity extremely well-supplied through these diversified supply channels.

Across the Atlantic, the U.S. biofuel market is showing interesting developments that could influence global oilseed flows. D4 RINs have strengthened, bringing biodiesel crush margins to around -17, nearly matching the potential 45Z credit value under the GREET model for soybean oil. This RIN strength could persist, especially if gasoil continues its downward trajectory, potentially affecting global trade flows and pricing relationships.

Looking ahead, the convergence of bearish factors in both oilseed and gasoil markets puts the traditional BOGO (Bean Oil Gas Oil) spread relationship under pressure. A rapid decline in gasoil prices could paradoxically support biodiesel premiums as blenders adjust their positions. This dynamic is already visible in the RME/FAME 0 spread, which has compressed to below +40 despite RME gross margins holding at $102/mt even in the face of record Australian imports. With the European rapeseed harvest approaching and global oilseed supplies remaining abundant, led by Brazil's massive 169 million tonne soybean crop, these market relationships will require careful monitoring in the months ahead.