The End of the UCO Golden Age: Why 2024 Was Peak Global Trade

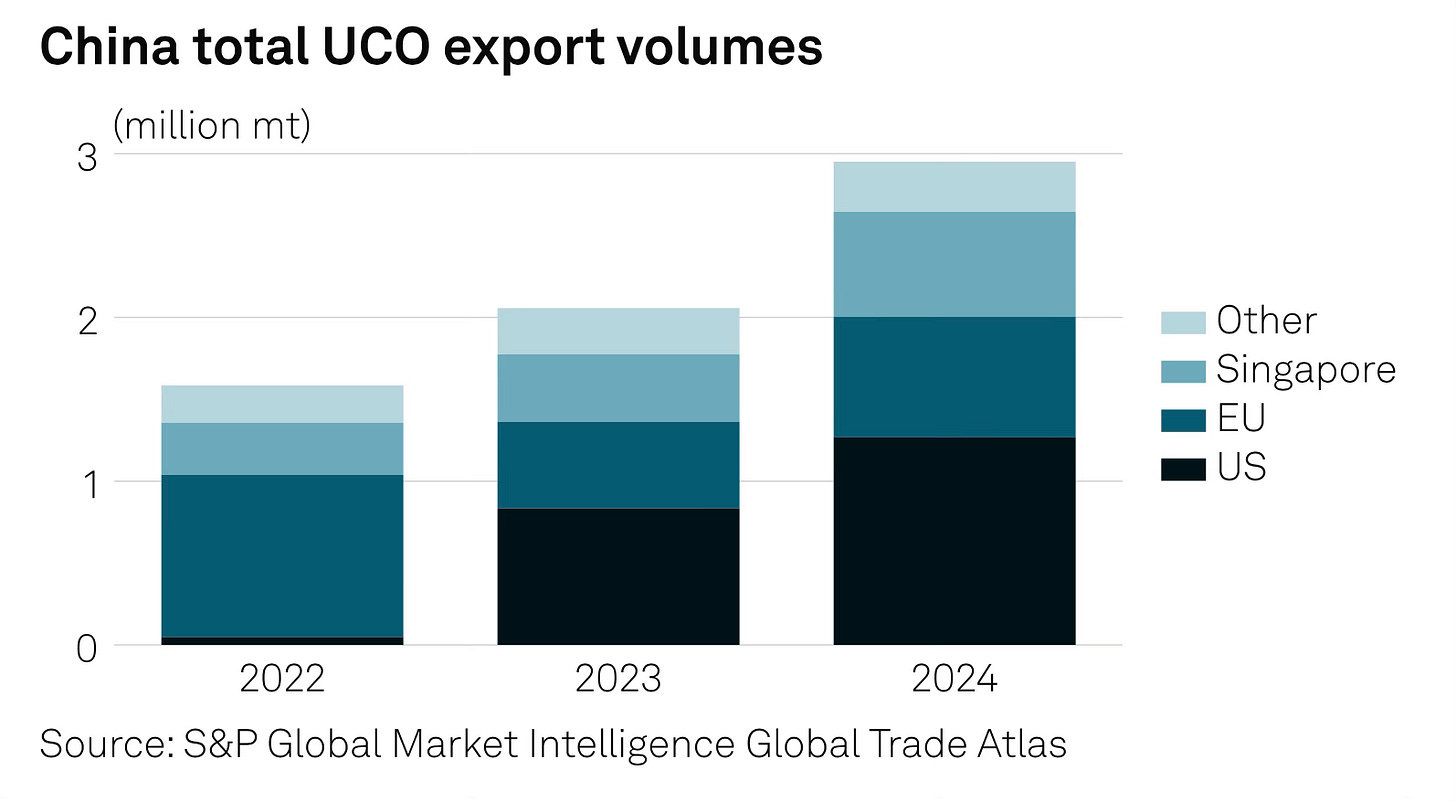

The used cooking oil (UCO) market hit record volumes in 2024, with China alone exporting 1.36 million metric tons to the US in just the first 11 months. However, this peak trading year marks the end of an era as multiple policy changes reshape global trade flows. Current UCO prices tell the story - Chinese bulk UCO has dropped to $980-1,000/t FOB, while European ARA prices hover around $1,200/t as markets digest the new reality.

Southeast Asian dynamics highlight the shifting landscape. Indonesia's recent export ban removed a major supplier, while Vietnamese UCO prices have fallen to $910-930/t FOB. Malaysia and Singapore's roles as major trading and storage hubs face particular uncertainty - Singapore had emerged as a significant destination for Chinese UCO that was ultimately destined for US renewable diesel production. With US subsidies now unavailable to foreign producers, these facilities must increasingly rely on RIN generation economics, fundamentally altering regional trade flows.

The US market transformation is particularly stark. The combination of cancelled Chinese export rebates, new 10% tariffs, and critically, the exclusion of foreign UCO from the new 45Z tax credit effectively closes the premium US market that drove global trade. This disrupts not just direct US-bound trade but also the complex supply chains through Singapore's processing facilities. US renewable diesel producers universally favor HVO production over SAF despite dual-production capability, with SAF trading at a $103/mt discount to HVO Class II. Major producers like Valero, P66, and Marathon all indicate stronger returns from HVO, but foreign producers now face much tougher economics without 45Z support.

Europe appears the natural destination for displaced Asian UCO volumes, but this creates its own challenges. While European demand is supported by both biodiesel and SAF mandates, the market cannot easily absorb the volume previously flowing to the US and Singapore. The growth in co-processing UCO at conventional refineries to meet SAF mandates adds another layer of competition and pricing pressure. Even with Europe as the default destination, traders worry about potential restrictions similar to the US policy shift. We hear anecdotal evidence of differential pricing for Asian and non-Asian UCO.

Looking ahead, 2025 will likely see significantly reduced global UCO trade volumes as markets regionalize. A significant shift appears underway in Brussels' regulatory approach - the exemption of 80% of importers from CBAM requirements, coupled with the postponement of deforestation rules, signals a more pragmatic stance on green legislation. This cooling of regulatory fervor suggests European policymakers are increasingly aware of economic realities and implementation challenges. The UCO market faces additional pressure from conventional refiners' increasing co-processing of UCO to meet SAF mandates, with SAF's $103/mt discount to HVO (RD) creating further pricing challenges. The fundamental transformation of UCO markets is irreversible - the loss of US premium pricing combined with co-processing competition will pressure global values, likely leading to more domestic consumption within producing regions. While Europe's more measured approach to green regulation is welcome news for traders, it won't restore the golden age of unrestricted global UCO trade we saw peak in 2024.